Take a More Strategic Business Outcome Focused Approach to PPM

The banking, insurance and financial services industries are dealing with unprecedented challenges. You are expected to innovate, delivering new services in new ways like never before, and providing customers with access from anywhere, in any format and at any time. Yet, at the same time, you must maintain world-class security and privacy standards in an environment that is subjected to more potential threats than ever before.

Be More Than Just a Status Quo PMO

Meeting the Need

Customers of all forms of customer services are no longer willing to accept the limited range of options traditionally offered by companies in the banking, insurance and financial services sector. They expect flexible products, consumed how they want, and supported by tools that put control in the hands of the consumer. To meet that need, and to maintain alignment as expectations and disruptive technologies evolve, companies must be able to innovate, delivering new services in new ways while maintaining the long-term strategic focus.

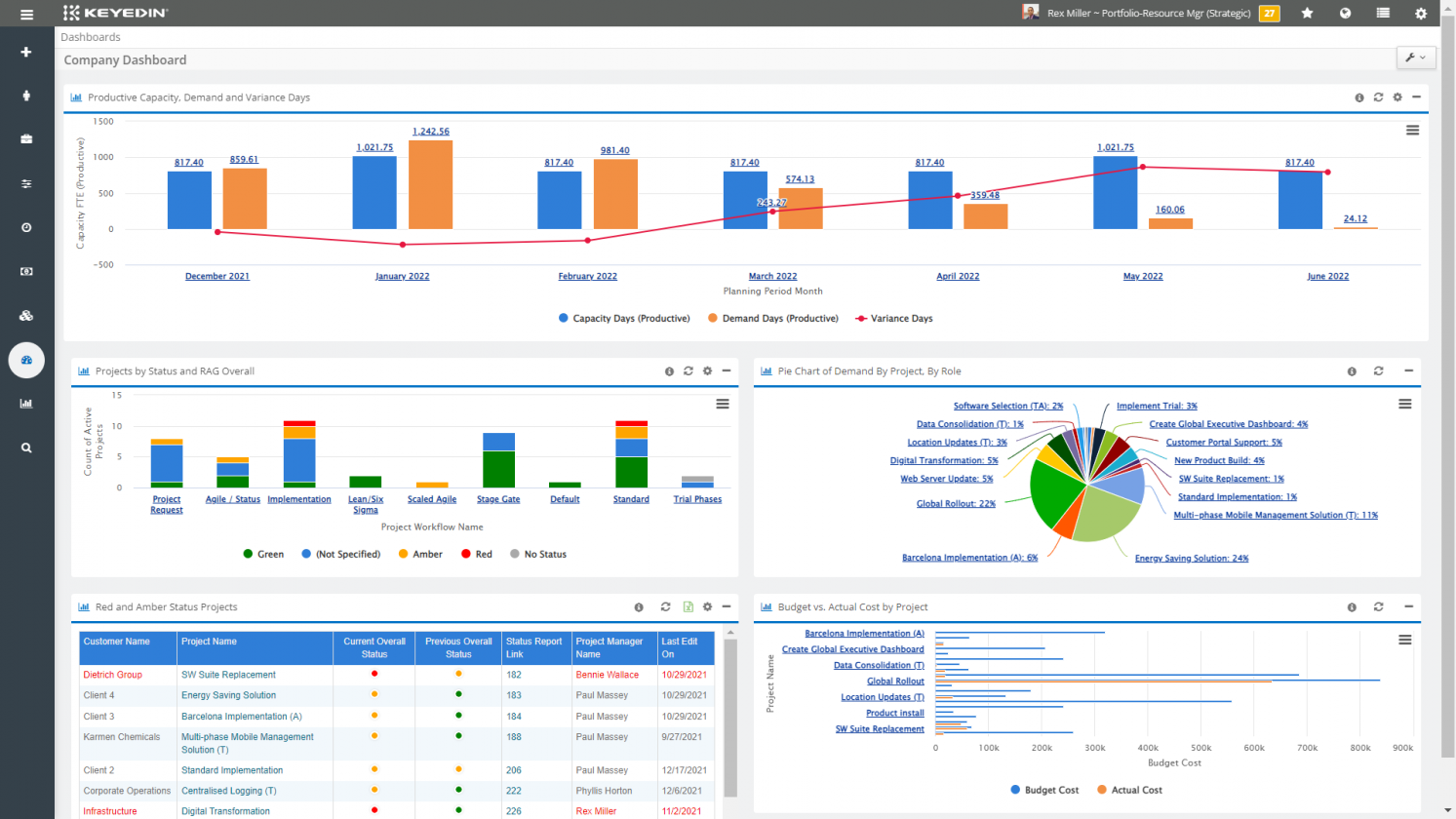

Achieving that requires a PPM solution that supports investments and projects driven directly from strategy, while still enabling rapid pivots when new threats and opportunities emerge. It requires meaningful, contextualized insight from reports that allow business leaders to make better decisions in less time, and to validate that those decisions are driving the right improvements, delighting customers and delivering on strategy.

Transparent Compliance

Few industries are as regulated as those around banking, insurance and financial services. Internal and external audit functions, multiple regulatory bodies, and compliance requirements that span the largest strategies to the smallest transactions, all require meeting the highest standards with complete transparency. But firms can’t allow compliance to slow down their businesses.

That’s where the right PPM solution comes in. Whether it’s ensuring that the projects to meet the latest regulatory requirements are being delivered in time and with optimal efficiency, or whether it’s generating audit and compliance reports from the PPM platform itself, with KeyedIn, leaders always have insight into what’s happening and there is never any doubt around whether the organization is meeting all of its regulatory requirements.

Optimized Resources, Optimized Performance

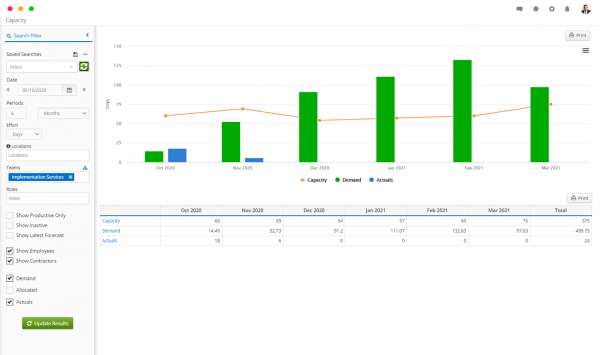

With new products, services, and requirements, comes new skills needs, more diverse ways of working, and more dynamic change in industries that have been historically stable and slow to evolve. Keeping up with that acceleration while still optimizing ROI requires the ability to ensure all resources are utilized in the best possible way at all times. Whether it’s resource capacity changes or evolving capability requirements, you need insight into your resourcing requirements for projects, and operations, both today and in the future.

That’s where the right PPM solution comes in. With KeyedIn you can combine reliable planning and forecasting with complete and timely tracking of actuals, allowing you to understand where your resource challenges and opportunities are and supporting rapid adjustments to optimize the ability to deliver – and to achieve outcomes.

Diverse Solutions, Integrated Management

Banking, Insurance and Financial Services may have more diversified offerings, and operations, than ever before, but that doesn’t mean that the management of all those initiatives and service lines have to be separate and distinct. In fact, to ensure the best possible performance, there must be an integrated approach to all offerings and between current operations and strategic plans. Siloes between departments must be broken down, collaboration within and across teams must be supported, and connections between project and operational teams must be optimized.

With KeyedIn Enterprise you can achieve that. From strategic roadmaps to plan and communicate the vision and direction of everything from the overall company to individual offerings, to the integrated management of every aspect of every initiative delivered in every work method, you can have a complete picture of everything that is happening. That drives better decisions, and that drives improved performance.

Easy and Fast Implementation with easy education for the end users

"Quick, efficient! From the top of the application implementation it was easy to educate the end users. The application is easy to navigate and has excelled reports to keep everyone on track. Overall I would recommend this application to others."

Clinical Implementation Specialist in the Healthcare Industry

A selection of our customers from the Banking, Insurance and Financial Services industries.

- Bupa

- Vitality

- goeasy

- PIMCO

- Church Mutual

- Atom Bank

- Schroders

- Experian

- CreditSafe

- Mortgage Advice Bureau

- Experian

- CardTronics

- NHBC

- Legal & General

- Ageas

A Year in the Life of KeyedIn

Learn from Vitality Health as they describe their partnership with KeyedIn.

Download the Case StudyInsight Sourcing Group

Learn from the Insight Sourcing Group as they describe their journey to improved resource management.

Download the Case StudyMEDHOST

Learn how improved resource management helps MEDHOST® cope with rapidly fluctuating client demands.

Download the Case StudySolenis Case Study

How Solenis Created an Enterprise PMO for Data-driven Analysis and Corporate Success

Download the Case Study Case Studies

Solenis Case Study

How Solenis Created an Enterprise PMO for Data-driven Analysis and Corporate Success

Download the Case Study Case Studies

A Year in the Life of KeyedIn

Learn from Vitality Health as they describe their partnership with KeyedIn.

Download the Case Study Case Studies

Insight Sourcing Group

Learn from the Insight Sourcing Group as they describe their journey to improved resource management.

Download the Case Study